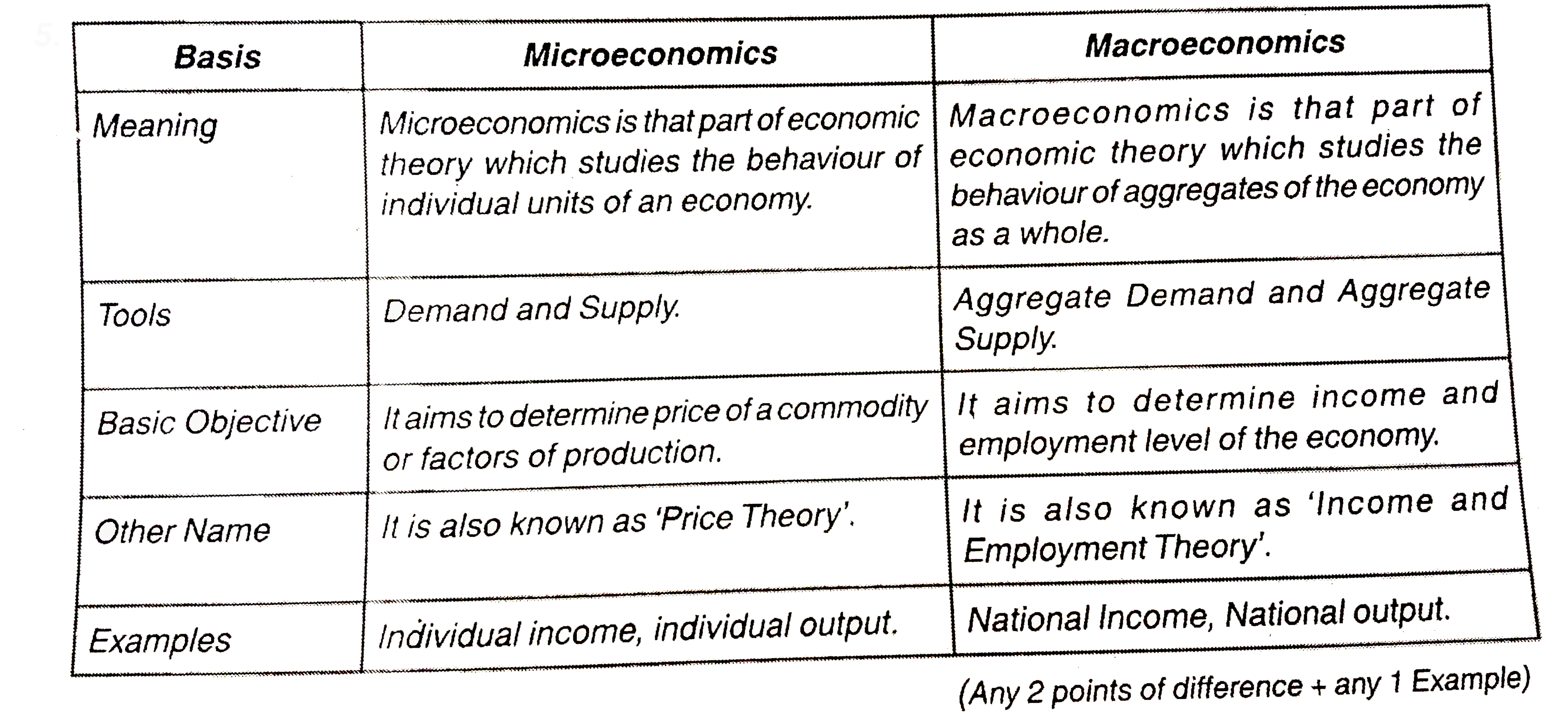

Having a holistic view of the economy is incredibly important as it provides broader context for strategic decisions and enables a clear understanding of topical issues such as economic growth, sustainability of pensions, optimal taxation, unemployment and banking regulation. Macroeconomic analysis is used to craft economic and fiscal policy and is applied to many areas, including the labour market, monetary theory and central banks objectives. Macroeconomic theory uses a top down approach, which facilitates the understanding of the overall economic framework in which countries and governments operate. Let’s take a look a closer look at how: The big picture Econometrics uses mathematics and statistical inference to turn theoretical economic models into useful tools for policy making.Īll three play a key role in strategic decision and policy making within banking and finance. Where microeconomics is concerned with individual units in the economy, such as a consumer or company, macroeconomics is an aggregate analysis of the economy as a whole. Econometrics, which seek to apply statistical and mathematical methods to economic analysis, is widely considered the third core area.

Macro and micro are not the only subfields within economics. However, as the theory has evolved over time, the distinction between the economy as a whole and the influencing factors within it – known as macro and microeconomics respectively – are now institutionalised, individual disciplines within economic theory. It was simply ‘economics’ - the study of how human societies organise the production, distribution, and consumption of goods and services.

Before the 1930s Great Depression in the US, economists did not widely distinguish between the economy as a whole and how people and businesses make decisions on a smaller scale.

0 kommentar(er)

0 kommentar(er)