In 73 days customers make a purchase, are reminded that payment is due, send payment, have payments processed, and have receivable accounts closed. This means that all open accounts receivable are collected and closed every 73 days. Manufactco’s accounts receivable equation for the number of days a receivable is outstanding is:ģ65 days / 5 times = 73 days for AR to turnover The number of days for this period, then, would be 365. The period for this example begins at 1/1/09 and ends at 12/31/09. A properly trained CFO, however, has the answers to this and many other questions. Many companies Google “accounts receivable turnover ratio calculator”, look towards their BA II, or scour their local bookstore. How many accounts receivable turnover days will it take to complete one cycle?ĭays Receivable Outstanding = # of days / accounts receivable ratio calculation Now let’s make things a bit more complicated.

This is the accounts receivable turnover ratio meaning.

ACCOUNTS RECEIVABLES TURNOVER RATIO FORMULA FULL

To rephrase, in a full year all open accounts receivable are collected and closed 5 times. She has found that a full turnover happens 5 times in one year. This person is known as a Chief Financial Officer a CFO.

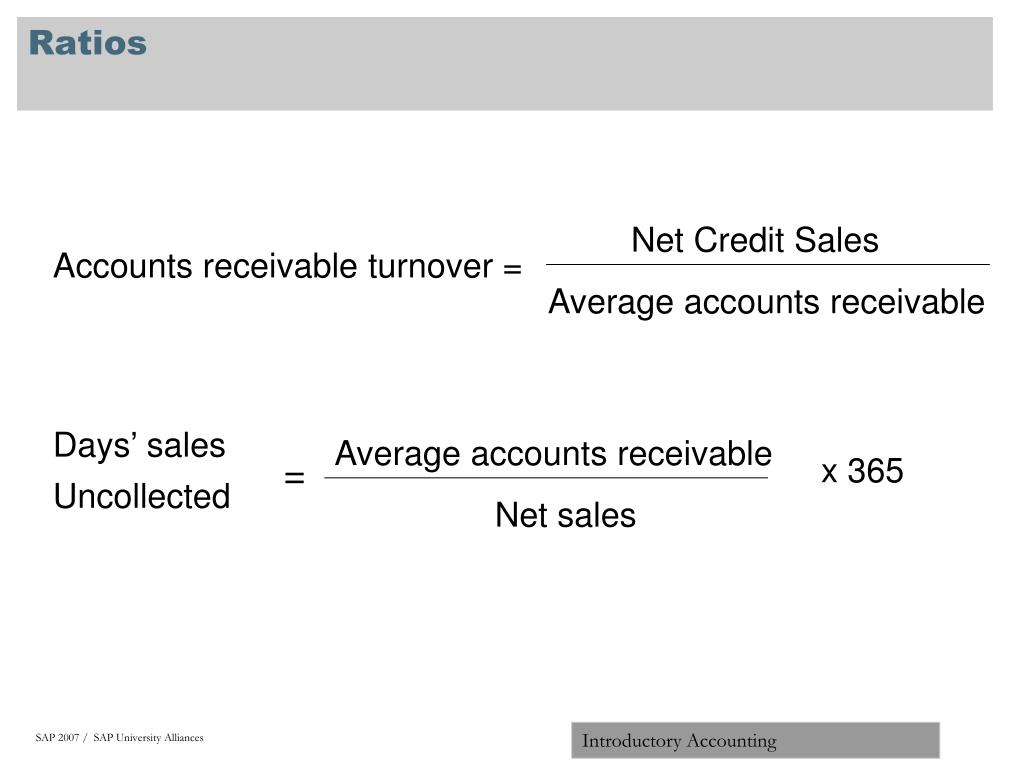

The company is growing quickly and must hire new employees for their plant.Ĭurrently, Manufactco’s accounts receivable turnover rate is:Įvery company should have someone tasked as, amongst other bookkeeping matters, head accounts receivable turnover calculator. Manufactco’s widgets have become very popular. Manufactco is a company that manufactures widgets. These rates are essential to having the necessary cash to cover expenses like inventory, payroll, warehousing, distribution, and more. Many companies live and die by collections. To emphasize it’s importance we will provide an accounts receivable turnover ratio example. When this is done, it is important to remain consistent if the ratio is compared to that of other companies.Įxample: assume annual credit sales are $10,000, accounts receivable at the beginning is $2,500, and accounts receivable at the end of the year is $1,500. Investors can use total sales as a shortcut. In real life, sometimes it is hard to get the number of how much of the sales were made on credit. It is quantified by the accounts receivable turnover rate formula.Īccounts Receivable Turnover = Annual credit sales / Average accounts receivableĪverage Accounts Receivable is the average of the opening and closing balances for Accounts Receivable. An accounts receivable turnover decrease means a company is seeing more delinquent clients. Phrased simply, an accounts receivable turnover increase means a company is more effectively processing credit. Company should re-evaluate its credit policies to ensure timely receivable collections from its customers.Ī profitable accounts receivable turnover ratio formula creates survival and success in business.

Also, there is an opportunity cost of holding receivables for a longer period of time.

Many companies even have an accounts receivable allowance to prevent cash flow issues.Ī high accounts receivable turnover indicates an efficient business operation or tight credit policies or a cash basis for the regular operation.Ī low or declining accounts receivable turnover indicates a collection problem from its customer. It is an important indicator of a company’s financial and operational performance. It can be expressed in many forms including accounts receivable turnover rate, accounts receivable turnover in days, accounts receivable turnover average, and more.Īccounts receivable turnover measures how efficiently a company uses its asset. The higher the turnover, the faster the business is collecting its receivables. It can be used to determine if a company is having difficulties collecting sales made on credit. Accounts Receivable Turnover ratio indicates how many times the accounts receivables have been collected during an accounting period.

0 kommentar(er)

0 kommentar(er)